How to select a tax system for FY 2023-24: Numerous salaried taxpayers are finding it difficult to choose between the old and new tax administrations, particularly those in the upper-income bracket who are making numerous tax-saving investments.

Nonetheless, this is the time of year when every salaried employee must inform his or her employer of his or her tax regime preference; otherwise, the employer will deduct TDS from the employee’s salary based on the new regime rates, minus the deductions and exemptions available under the old regime. Consequently, the following will assist you in choosing the optimal tax regime for optimum tax savings.

Comparing both tax administrations is the first stage in deciding which one to adopt. A salaried taxpayer could claim several tax deductions, exemptions, and allowances under the previous system. It permits employees to utilize a variety of tax-reduction strategies.

Taxpayers can deduct up to Rs. 1.5 lakh under Section 80C, the most popular deduction method.

Under the previous system, exemptions included House Rent Allowance (HRA) and Leave Travel Allowance (LTA). Section 80C is the most prevalent deduction option, allowing taxpayers to reduce their taxable income by up to Rs. 1.5 lakh. Under the previous system, the Section 87A tax rebate was available for incomes up to Rs 5 lakh. This increases to Rs 7 lakh under the new system.

“Before selecting a tax regime, it is important to consider a number of factors. The individual should verify his total income. He should also assess the amount of tax savings investments he has made. In addition, the availability of HRA benefits and the ability to carry forward losses are two important considerations before selecting the tax regime. In the new regime, there is no concept of additional depreciation for industrialists, so a tax regime must be chosen accordingly, according to Atul sharma, founder of Lex N Tax.

Dr. Suresh Surana, founder of RSM India, explains, “Both the previous tax regime and the new tax regime under section 115BAC of the IT Act have their advantages and disadvantages. The decision of the taxpayer to select one of these tax regimes is typically influenced by a variety of factors, including investment goals and objectives, income levels, applicable tax rates, exemptions and deductions available, etc. Before making a decision, a comprehensive comparative evaluation and appraisal under both tax regimes must be conducted.”

Dr. Surana suggests the following factors for taxpayers to consider when selecting the optimal tax regime:

Individual taxpayers with a total income of up to Rs. 7,50,000 can elect for the new tax regime under section 115BAC of the IT Act and claim a standard deduction of up to Rs. 50,000 under section 16(ia) of the IT Act. In addition, the effective tax rate would be zero due to the ability to claim a rebate under section 87A of the IT Act.

The former tax regime may be preferred by taxpayers who intend to claim deductions under Chapter VI-A or exemptions, leave travel concessions, housing rent allowances, housing loan repayments, etc.

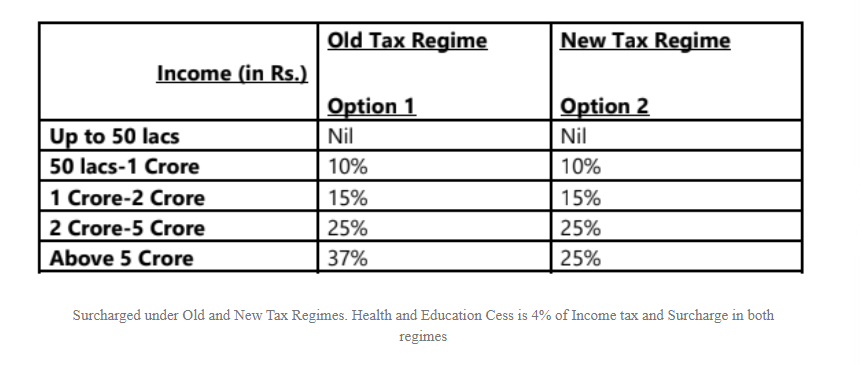

In addition, the reduction in surcharge rates from 37% to 25% for total incomes exceeding Rs. 5 crores reduces the effective tax rate from 42.744% to 39%.

Use the Income Tax Calculator to decide

A calculation is another method to choose between the old and new administrations. The following Income Tax calculator will be of assistance to you:

List of Tax Deductions and Exemptions under the Previous Tax System

- Investments under Section 80C up to Rs 1.5 lakh (Public Provident Fund, Equity Linked Savings Scheme (ELSS), Employee Provident Fund, Life Insurance Premium, Home Loan Principal etc).

- Home Loan Interest Payment (up to Rs 2 lakh)

- Children Education and Hostel Allowance

- Helper Allowance

- Health Insurance Premiums – Rs 25,000 for Self, Spouse and Children and another Rs 25,000 for parents (Rs.50,000 for senior citizens)

- Expenses on medical treatment, training or rehabilitation of a

- disabled dependent: Rs.75000 (Rs.125000 for the person with severe disability )

- Treatment of self or dependent for specified disease: Rs 40,000

- (Rs.1,00,000/- for senior citizens)

- Employee’s contribution to NPS up to Rs 50,000

- Interest on Education Loan

- Donation to specified institutions

- Saving Bank Account Interest up to rs 10,000 under Section 80TTA

- Disability of self: Rs.75,000 to Rs.1,25,000 depending on disability

- House Rent Allowance

- Leave Travel Allowance

- Mobile and Internet Reimbursement

- Food Coupons or Vouchers

- Company Leased Car

- Standard Deduction

- Uniform and Washing Allowance

- Leave Encashment

A salaried employee could effectively reduce his or her tax liability by thousands under the previous regime by investing in tax-saving instruments and claiming exemptions.

Nonetheless, with the exception of the standard deduction, none of the aforementioned tax benefits are available under the New Tax Regime for FY 2023-24. The employee can only take advantage of the new regime’s low tax rates if he or she is willing to forego the various deductions and exemptions available under the old regime.

This means that if an employee chooses the new regime, he or she will have to give up essential exemptions such as LTA, HRA, and various deductions under Sections 80C, D0D, 80E, and 80G, as well as interest payment on a home loan under Section 24 (b).

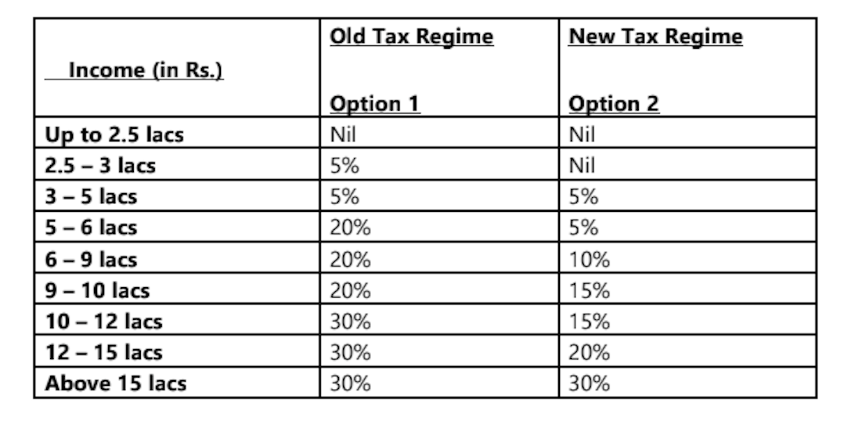

Tax Rates under the Old and New Regimes

Surcharges in the New and Previous Tax Systems

In conclusion, it can be stated that both tax administrations have advantages and disadvantages. If you are investing in various tax-saving instruments and incurring expenditures that qualify for exemptions, you can elect for the old regime if your calculations indicate that you will save more under the old system.

If not, you should choose the New Regime because it is straightforward and you do not need to invest or spend for tax savings.