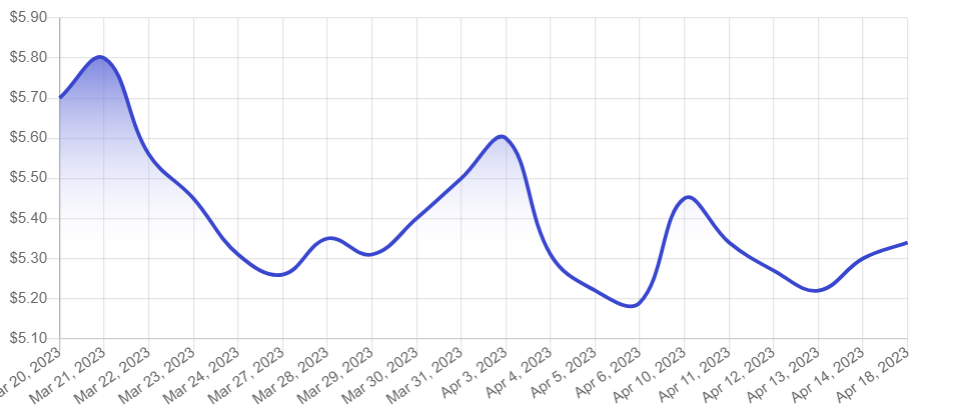

On Monday, US speciality retailer Chico’s FAS began trading at $5.30. With 50- and 200-day moving averages of $5.49 and $5.45, the stock is steady. The company’s debt-to-equity ratio is 0.15. Chico’s FAS has 0.53 fast and 1.14 current ratios.

The stock fluctuated between $3.80 and $7.30 during the past year, which should be considered when designing investing plans. Chico’s FAS has a market valuation of $662 million with a price-earnings ratio of 6.02 and beta value of 1/20, suggesting growth potential.

Telsey Advisory Group reiterated that Chico’s FAS is ready for market performance but set a $6 price per share, while StockNews.com gave it a boost with a recent “buy” rating note. Investors may find either perspective useful.

Institutional investors regularly monitor this company’s sounds to capitalize on possibilities, but not all rising percentages lead to profits or value. Towle&Co and Commonwealth Equity Services LLC acquired over two thousand shares apiece, while Mackenzie Financial Corp bought over three thousand from this institution.

Chico’s FAS’s financial performance continues; last quarter earnings beat industry estimates with increases up to $0.06 per unit sold totalling over five hundred million dollars—another proof of this name’s resiliency.

Chico’s FAS, Inc. Expects Positive Q2 2024 EPS and Prioritizes Customer-Centric Model

B. Riley’s Q2 2024 EPS forecasts for Chico’s FAS, Inc. (NYSE:CHS) were announced on Thursday, April 13th. J. Lick of B. Riley predicts Chico’s FAS will earn $0.25 per share for the quarter due to the company’s excellent financial position and rising market demand.

Chico’s FAS is known for offering high-quality items internationally. New product lines for varied client interests and lifestyles are introduced often. Chico’s FAS is known worldwide for its innovative goods and top-notch service.

The specialty retailer’s forecasted profits match consensus projections for Chico’s FAS’s current full-year earnings at $0.83 per share, its Q3 2024 earnings at $0.14, Q4 2024 at $0.13, FY2024 at $0.78, and FY2025 at $0.79.

Director Bonnie R. Brooks sold Chico’s FAS stock on Thursday, March 16th (69,600 shares), Friday, March 10th (30,400 shares), and Thursday, March 16th again (69,600 shares). Sales ranged from $186 thousand to $437 thousand at an average price of $6.15 to $6.28 per share.

Director Bonnie R. Brooks’ sales transactions have sparked suspicions that Chico’s FAS stock may fall, although most economists expect the business to recover. Chico’s FAS’s continuous growth and profitability make investors optimistic.

A Strong Business with Strong Financials

Due to its customer-focused approach and inventive marketing, the specialized store enjoys a great reputation in retail. The firm focuses on customer demands, providing superior items and a smooth buying experience. This approach assures continuing customer loyalty and corporate success by providing exceptional customer service.

Finally, equity experts at B. Riley’s estimate is excellent news for Chico’s FAS investors hoping for long-term value. Despite director Brooks’ recent stock transactions, many financial analysts expect Chico’s FAS to continue rising owing to its devotion to product quality and customer service. Chico’s FAS will become an industry leader and create significant value for stakeholders with its impeccable reputation.