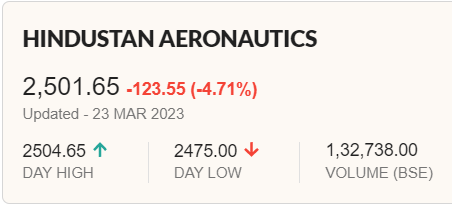

As the government issued an offer for sale (OFS) to sell a 3.5% interest in HAL at a minimum price of 2,450 per share, shares of Hindustan Aeronautics Ltd (HAL) fell more than 5% to 2,475 each on the BSE.

The PSU defense business said on Wednesday that the government plans to sell up to a 3.5% share in an aerospace and defense company this week in a transaction that may net the government 2,867 crores. The floor price for the HAL stake sale has been set at 2,450 per share, below Wednesday’s closing price.

Hindustan Aeronautics Ltd shares drop

On March 23-24, the government intends to sell a 1.75 percent share and has the option to sell an additional 1.75 percent stake if necessary. The two-day Offer For Sale (OFS) will begin on Thursday for institutional investors and on Friday for regular purchasers. The government owns 75.15 percent of HAL, which is under the Defense Ministry’s Central Public Sector Enterprises (CPSE).

The OFS includes a basic issue size of 1.75 percent, or 58.51 million shares, with the option to retain oversubscription of an equivalent amount. “Should the oversubscription option be exercised, the equity shares comprising the base offer size plus the oversubscription option will constitute 3.50 percent (1,17,03,563) of the company’s equity shares,” HAL said in a statement with the Securities and Exchange Commission.

The government has amassed 31,106,6 billion thus far through disinvestment and share buybacks in CPSEs. In comparison to the budgeted amount of 65,000 crore, the government cut down its disinvestment revenue expectations for the current fiscal year to 50,000 crore last month.

For the quarter ending in December 2022, state-owned Hindustan Aeronautics Ltd recorded a net profit of 1,155 crore, an increase of 24% year-over-year compared to 935 crore. Nevertheless, its income from operations decreased to 5,665 crore compared to 5,894 crore in the same quarter of the previous year.